Summary: As the subsidy policy for corn deep-processing expired in Jilin Province on 1 July, 2016, all domestic subsidy

policies for corn deep-processing have been officially canceled in China.

Fortunately, corn deep-processing enterprises will not be impacted thanks to

the slumping corn price and their transformation to reduce purchase cost.

Actually, both price and supply of corn are positive for them now.

Since 1 July, 2016, the previous subsidy of

USD22.56/t (RMB150/t) for corn deep-processing has expired in Jilin Province,

according to the Notification of Subsidy Management for Corn Purchase by Corn

Deep-processing Enterprises in H1 2016 published by the Jilin Provincial Grain

Administration, subsidy for corn deep-processing, which used to be USD22.56/t

(RMB150/t), has expired since 1 July. In

fact, Heilongjiang Province and Inner Mongolia Autonomous Region had canceled

their subsidies in succession.

Subsidy policy for corn deep-processing was

first implemented in 2014, aiming at alleviating the tough operation of

deep-processing enterprises in Northeast China, improving enterprises'

initiatives in production, and increasing their operating rate. Additionally,

the subsidy policy aimed to improve transaction volumes at auctions of corn, so

as to relieve high pressure of enterprises that have large inventories in

Northeast China.

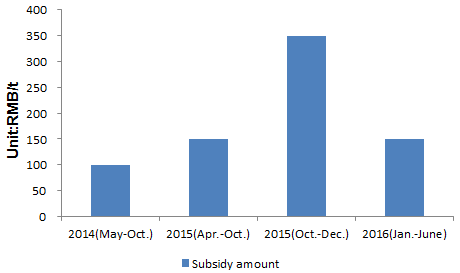

Subsidy amount for corn deep-processing in

Jilin Province, 2014-2016

Note: USD/RMB exchange rate:

USD1.00=RMB6.6496.

Source: Jilin Provincial Grain

Administration

CCM predicts that the cancelation of

subsidy policy would not have much impact on deep-processing enterprises,

given:

1. Domestic corn price had already

fallen back.

The subsidy policy was issued to reduce

cost for deep-processing enterprises as corn price stood high in 2014/15. So

far, the domestic market price of corn has remarkably fallen back, and the role

of the subsidy has become scarcely significant. According to CCM's price

monitoring, market price was USD291.35/t (RMB1,937/t) in H1 2016, down 24.28%

YoY.

2. The development and

transformation of deep-processing enterprises have reduced the impact from

subsidy on their production costs.

Through years' transformation and

development, corn purchase cost became less influential to enterprises. For

example, MSG producer Henan Lotus Flower Gourmet Powder Co., Ltd. was renamed

as Lotus Health Industry Holding Group Company and marched into health

industry; corn oil producer Xiwang Foodstuffs Co., Ltd. also developed into

health care industry by acquiring a health care enterprise. Others vigorously

developed downstream high added-value products. For instance, corn starch

producer Zhucheng Xingmao Corn Developing Co., Ltd. is active in developing and

promoting modified starch, maltodextrin and other products. MSG and amino acid

maker Fufeng Group Co., Ltd. highly promotes its xanthan gum.

Currently, the domestic corn market is

mainly occupied by policy-oriented corn. Auctions of corn for temporary storage

have launched since 14 July, 2016, and the volume of corn put on 21 July

auction was increased from 200 tonnes to 300 tonnes, which shows that

inventories are running out at higher speed. Besides, with newly-harvested corn

entering market and the gradually falling price, the purchase difficulty for

deep-processing enterprises in earlier period will be ameliorated. It means

that enterprises will be in advantage for corn purchase, no matter in supply or

price.

About CCM:

CCM is the leading market intelligence

provider for China’s agriculture, chemicals, food & ingredients and life

science markets. Founded in 2001, CCM offers a range of data and content solutions, from price

and trade data to industry newsletters and customized market research reports. Our clients include Monsanto, DuPont, Shell, Bayer, and Syngenta. CCM is a

brand of Kcomber Inc.

For

more information about CCM, please visit www.cnchemicals.com or

get in touch with us directly by emailing econtact@cnchemicals.com or

calling +86-20-37616606.

Tag: corn